Pan Aadhaar Link Status Check

Table of Contents

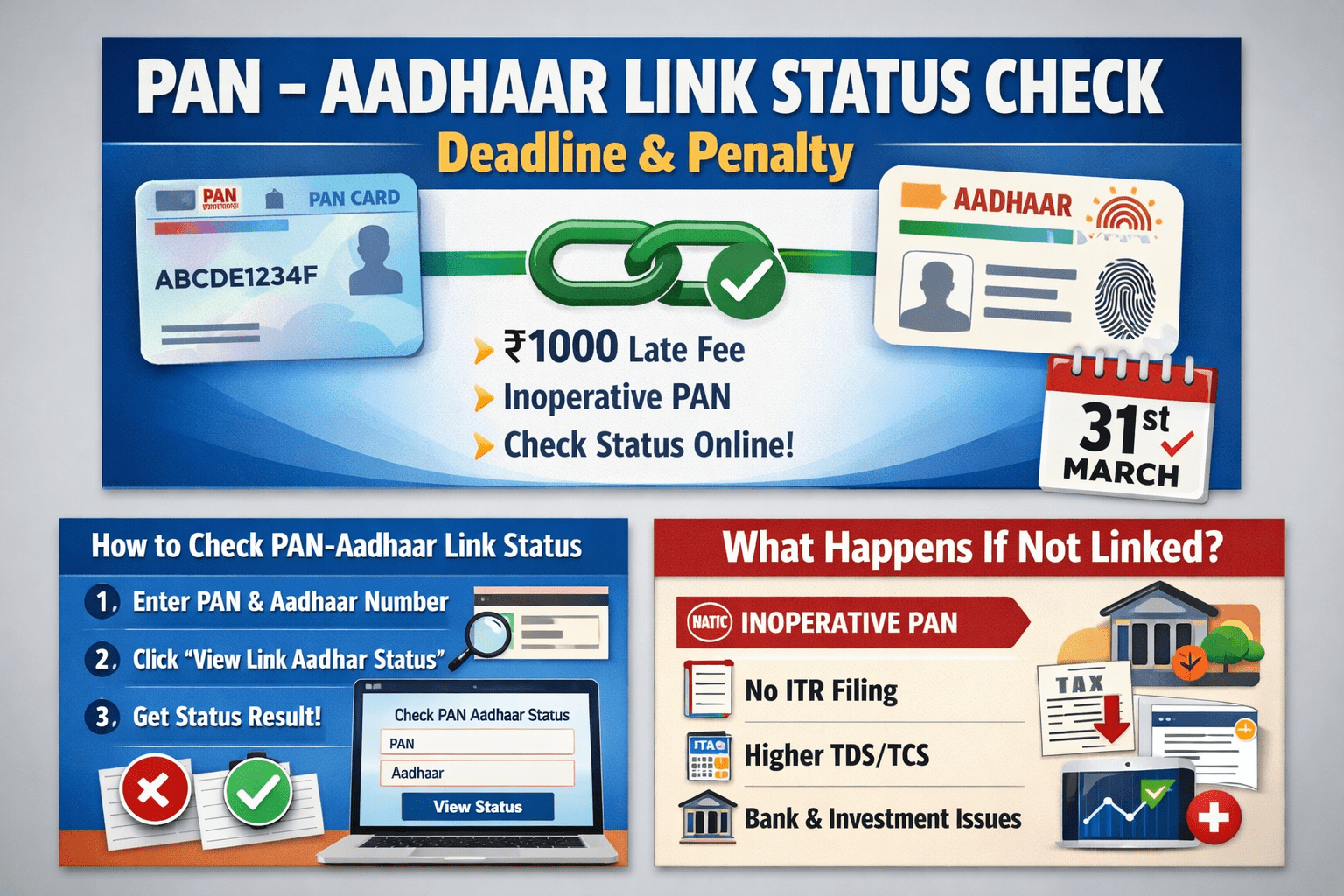

Linking PAN with Aadhaar is no longer just a formality—it has become a mandatory compliance requirement for Indian taxpayers. If you are unsure whether your PAN and Aadhaar are already linked, or you want to check the PAN Aadhaar link status online before the deadline, this guide explains everything in simple terms.

From step-by-step instructions to penalties for non-linking, here is a complete and humanized overview.

Why PAN Aadhaar Linking Is Mandatory

The Government of India has made PAN–Aadhaar linking compulsory under Section 139AA of the Income Tax Act. The primary purpose is to:

- Eliminate duplicate PAN cards

- Improve tax compliance

- Prevent tax evasion

- Enable seamless financial transactions

If your PAN is not linked with Aadhaar, it may become inoperative, which can cause serious financial inconvenience.

PAN Aadhaar Linking Deadline (Latest Update)

The PAN Aadhaar linking deadline has already passed. However, taxpayers who missed the original deadline can still link PAN with Aadhaar by paying a late fee.

Current Status:

- Late linking allowed with penalty

- ₹1,000 fee applicable for linking after the deadline

- PAN remains inoperative until Aadhaar is linked

It is strongly advised to complete the process as soon as possible to avoid further issues.

How to Check PAN Aadhaar Link Status Online (Step-by-Step)

Checking your PAN Aadhaar link status online is quick and completely free. You do not need to log in.

Method 1: Via Income Tax e-Filing Portal

- Visit the official Income Tax e-Filing website

- Click on “Link Aadhaar Status”

- Enter your PAN number

- Enter your Aadhaar number

- Click on “View Link Aadhaar Status”

Result:

- If linked: You will see a confirmation message

- If not linked: The portal will prompt you to complete the linking process

How to Link PAN with Aadhaar Online (If Not Linked)

If your PAN Aadhaar status shows “Not Linked,” follow these steps:

- Visit the Income Tax e-Filing portal

- Click on “Link Aadhaar”

- Enter PAN, Aadhaar number, and name

- Pay the ₹1,000 late fee (if applicable)

- Submit the request

- Aadhaar OTP verification will complete the process

Once linked, your PAN will be reactivated automatically.

What Happens If PAN Is Not Linked with Aadhaar?

Failure to link PAN with Aadhaar can lead to multiple problems:

- PAN becomes inoperative

- Income Tax Return (ITR) filing not allowed

- TDS/TCS deducted at a higher rate

- Bank account opening issues

- Mutual fund, stock market, and property transactions may fail

In short, almost all financial activities requiring PAN can get blocked.

Common PAN Aadhaar Linking Errors & Solutions

Name Mismatch

- Ensure the name on PAN and Aadhaar is identical

- Update details on either PAN or Aadhaar if required

Date of Birth Mismatch

- Correct DOB via Aadhaar or PAN correction process

Aadhaar Not Updated

- Make sure Aadhaar is active and linked with mobile number

Final Words

If you have not checked your PAN Aadhaar link status, do it immediately. An inoperative PAN can silently disrupt your financial life—from tax filing to banking and investments. The process is simple, fully online, and takes just a few minutes.

Linking PAN with Aadhaar today ensures uninterrupted access to all financial and tax-related services tomorrow.

Is PAN Aadhaar linking mandatory for everyone?

Yes, it is mandatory for all PAN holders, except those specifically exempted (such as NRIs, super senior citizens above 80, and certain foreign nationals).

Can I check PAN Aadhaar link status without login?

Yes, you can check the status without logging in by using PAN and Aadhaar numbers.

How long does it take to activate PAN after linking?

Usually, PAN becomes operative within a few days after successful Aadhaar linking.

Is the ₹1,000 fee refundable?

No, the late fee paid for PAN Aadhaar linking is non-refundable.